aurora sales tax calculator

This is the total of state county and city sales tax rates. For small businesses the firm can help with tax saving strategies bookkeeping accounting startup consultations quickbooks payroll administration financial report compilations and general business consulting.

The combined rate used in this calculator 825 is the result of the illinois state rate 625.

. The December 2020 total local sales tax rate was also 7750. Below you can find the general sales tax calculator for Lindsey city for the year 2021. The minimum combined 2022 sales tax rate for Aurora Minnesota is.

The current total local sales tax rate in Aurora TX is 7750. Did South Dakota v. Lindsey Sales Tax Calculator For 2021.

Did South Dakota v. You can find more tax rates and allowances for Aurora Cd Only and Colorado in the 2022 Colorado Tax Tables. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing.

By Jerry Bryant May 2 2021. There are approximately 213758 people living in the Aurora area. An alternative sales tax rate of 675 applies in the tax region Centennial which appertains to zip code 80046.

An alternative sales tax rate of 881 applies in the tax region Denver which appertains to zip codes 80010 80012 80014 and 80019. The County sales tax rate is. Business Licensing and Tax Class Aurora offers a free workshop designed to help new and existing businesses understand business licensing and taxes.

Aurora Sales Tax Calculator For 2021. Wayfair Inc affect Ohio. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec.

This is the total of state county and city sales tax rates. Aurora in colorado has a tax rate of 8 for 2022 this includes the colorado sales tax rate of 29 and local sales tax rates in aurora totaling 51. Wayfair Inc affect Minnesota.

Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2. The sales tax jurisdiction name is Venice which may refer to a local government division. There is no applicable city tax or special tax.

0875 lower than the maximum sales tax in NY. Did South Dakota v. The minimum combined 2022 sales tax rate for Aurora Ohio is.

Autumnbrook Sales Tax Calculator For 2021. This is the total of state county and city sales tax rates. The Aurora sales tax rate is.

The sales tax vendor collection allowance is eliminated with the January filing period due February 20 2018. The County sales tax rate is. The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Aurora CO. The Ohio sales tax rate is currently. You can print a 8 sales tax table here.

The County sales tax rate is. The 8 sales tax rate in Aurora consists of 4 New York state sales tax and 4 Cayuga County sales tax. This is a custom and easy to use sales tax calculator made by non other than.

The New York sales tax rate is currently. The Aurora sales tax rate is. The Aurora sales tax rate is.

The colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. The December 2020 total local sales tax rate was 7250. Aurora colorado car sales taxMonthly if taxable sales are 96000 or more per year if the tax is more than 300 per month.

The Minnesota sales tax rate is currently. If this rate has been updated locally please contact us and we. Aurora Cd Only in Colorado has a tax rate of 7 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora Cd Only totaling 41.

The sales tax rate for Aurora was updated for the 2020 tax year this is the current sales tax rate we are using in the Aurora South Dakota Sales Tax Comparison Calculator for 202223. Wayfair Inc affect New York. The minimum combined 2022 sales tax rate for Aurora New York is.

You can find more tax rates and allowances for Aurora and Illinois in the 2022 Illinois Tax Tables. The current total local sales tax rate in Aurora OH is 7000. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

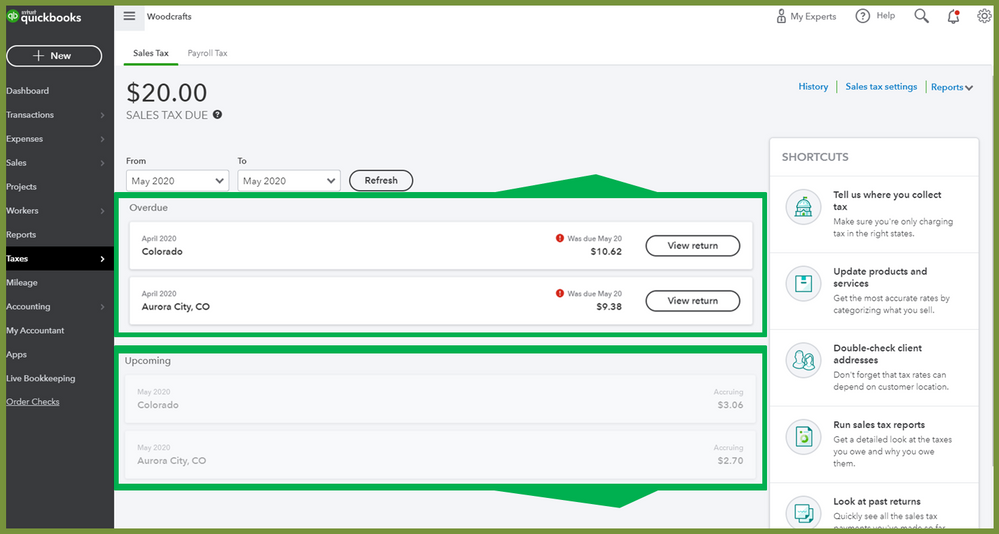

Set Up Automated Sales Tax Center

Property Tax Village Of Carol Stream Il

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

8 25 Sales Tax Calculator Template Tax Printables Sales Tax Tax

Aurora Colorado Sales Tax Rate Sales Taxes By City

How To Calculate Cannabis Taxes At Your Dispensary

What Is The Sales Tax On A Car In Illinois Naperville

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Aurora Property Tax 2021 Calculator Rates Wowa Ca

How To Use Tax Function On Calculator Youtube

Chicago Il Property Tax Rate Sale 53 Off Www Cremascota Com

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Chicago Il Property Tax Rate Sale 53 Off Www Cremascota Com

How Colorado Taxes Work Auto Dealers Dealr Tax

North Aurora Taxpayers Give 1 3 Million In Non Home Rule Sales Tax In 2021 Kane County Reporter

Nebraska Sales Tax Rates By City County 2022